COLOMBIA: TEMPORARY TAX MEASURES FOR 2026.

Decree No. 1474 of 2025 was issued within the framework of the State of Economic, Social, and Ecological Emergency declared by the National Government pursuant to Decree No. 1390 of December 22, 2025. It introduces a set of temporary tax measures, primarily applicable to tax year 2026, aimed at generating additional fiscal revenues to finance expenditures under the National General Budget and to mitigate the effects of the economic emergency.

Key Tax Measures

1. Income Tax

a. Temporary Supplementary Tax for Tax Normalization

For tax year 2026, a Temporary Supplementary Tax for Tax Normalization applies to taxpayers subject to:

-Income tax and complementary taxes; or

-Substitute income tax regimes,who hold omitted assets or non-existent liabilities as of January 1st, 2026.

Taxpayers without such items as of that date are not subject to this tax.

Taxable Event

The tax is triggered by the ownership of omitted assets or non-existent liabilities as of January 1st, 2026.

For purposes of the above, the Decree clarifies:

-Omitted assets: Assets that were not reported or were undervalued despite a legal obligation to declare them. The obligation rests with the individual or entity that holds the economic benefit of the asset.

-Non-existent liabilities: Liabilities reported without valid legal or economic support, intended solely to reduce the tax burden.

Tax Base

-Omitted assets:

-Fiscal cost as of January 1st, 2026; or

-A technically supported self-assessed market value, not lower than the fiscal cost.

-The declared value becomes the new tax basis going forward.

-Non-existent liabilities:

- Fiscal value or the amount reported in the most recent income tax return.

Anti-abuse provisions empower the Tax Authority (DIAN) to disregard artificial structures designed to reduce the taxable base.

Foreign Structures

Foreign private foundations, trusts, insurance products with a savings component, investment funds, and similar arrangements are treated as fiduciary rights held in Colombia, are subject to the tax under the tax transparency principle.

The founder, settler, or originator is deemed the taxpayer, regardless of the structure’s discretionary or irrevocable nature.

Applicable Rate: 19% flat rate

Key Benefits and Legal Effects

-No net worth comparison or income recognition.

-No penalties for income tax, VAT, transfer pricing, foreign asset reporting, or wealth tax.

-No criminal liability related to omitted assets or non-existent liabilities, unless an illicit origin is proven.

-Late registration of foreign investments will not trigger foreign exchange penalties, provided proper disclosure is made, and the tax normalization return is referenced.

-Taxpayers may update undervalued assets (excluding inventory) to market value by including the adjustment in the normalization tax base.

⚠️ Important: Tax normalization does not legalize illicit assets nor provide protection where unlawful origin is established.

b. Corporate Income Tax Surcharge – Financial Sector (2026)

For tax year 2026, financial institutions subject to the special regime under Article 240(2) of the Colombian Tax Code are required to pay an additional 15 percentage point surcharge, resulting in an effective corporate income tax rate of 50%.

The surcharge is subject to a 100% advance payment, calculated based on the prior year’s taxable income and payable in two equal installments. Consequently, the limitation previously applicable under Article 240(2) does not apply for 2026.

This measure significantly increases both the effective tax burden and cash-flow impact for financial institutions.

2. Wealth Tax

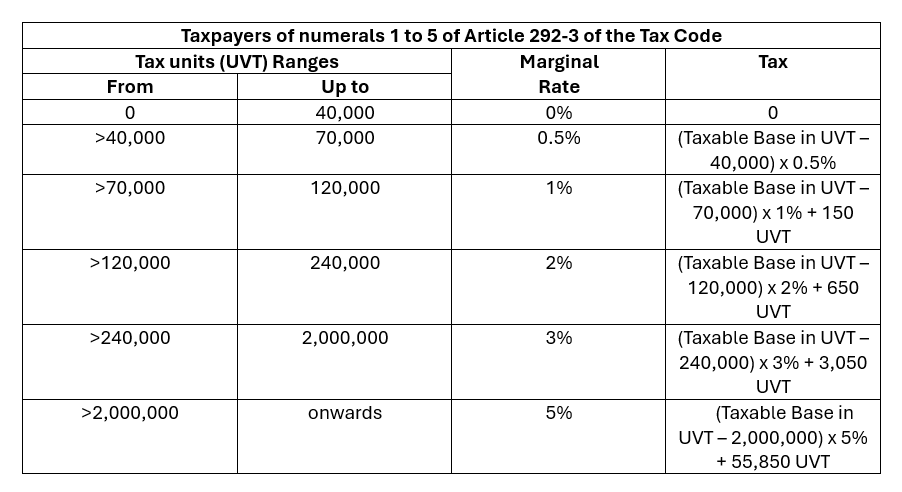

The Colombian Tax Code is amended to provide that for the 2026 tax year, the Wealth Tax applies to taxpayers holding net wealth equal to or exceeding 40,000 UVT as of January 1st, 2026. Net wealth is defined as gross assets minus valid liabilities.

Further, a temporary rate schedule applies, with marginal rates ranging from 0.5% to 5%, depending on the level of net wealth, detailed in the table below:

3. Value Added Tax (VAT)

a. VAT on Alcoholic Beverages

For 2026, goods subject to excise taxes on spirits, wines, aperitifs, and similar beverages, as well as products subject to departmental participation charges under monopoly regimes, are subject to VAT at the standard 19% rate.

The preferential VAT treatment under Article 468-1(2) of the Tax Code is temporarily suspended

The above may lead to the following practical impact:

-Increased VAT burden across the alcoholic beverage supply chain.

-Potential pricing and cash-flow implications.

-Enhanced coordination between national and departmental tax authorities.

b. VAT on Online Gambling and Games of Chance

For 2026, online gambling and games of chance operated via the internet, whether domestically or from abroad, are subject to VAT.

The VAT taxpayer is the operator of the games. For foreign operators, VAT applies under the same rules governing foreign service providers.

The taxable base is Gross Gaming Revenue (GGR), defined as total bets minus prizes paid during the relevant two-month period. VAT is calculated at the standard 19% rate.

Territorial Nexus: VAT accrues when the end-user has tax residence, domicile, permanent establishment, or place of economic activity in Colombia.

The VAT taxpayer is the operator of the games. For foreign operators, VAT applies under the same rules governing foreign service providers.

c. VAT Exclusion for Postal and Express Imports

VAT Exclusion for Postal Traffic, Express Shipments, and Rapid Delivery Services

During 2026, the VAT exclusion provided for in item (j) of Article 428 of the Tax Code shall only apply to imports of goods through postal traffic, express shipments, or rapid delivery services with a value not exceeding USD 50.

4. Compliance Measures

The Decree introduces temporary relief mechanisms, including:

-Reduced interest and penalties for outstanding obligations.

-Reduced penalties for omitted or corrected tax returns.

-Regularization of formal non-compliance.

-Judicial conciliation mechanisms in tax, customs, and foreign exchange litigation.

a. Late-Payment Interest and Penalties Temporary Reduction

Tax, customs, and foreign-exchange obligations administered by DIAN that are outstanding as of December 31st, 2025, may benefit from a temporary reduction of penalties and interest, provided full payment is made between the entry into force of the decree and March 31st, 2026.

Taxpayers may settle outstanding obligations with:

-100% payment of principal

-Late-payment interest at a reduced annual rate of 4.5%

-Payment of only 15% of penalties and penalty adjustments

The payable penalty may not be lower than the statutory minimum applicable in the year the penalty was assessed.

Payments must be completed from the effective date of the Decree through March 31st, 2026.

Key Considerations

-Existing payment agreements may be restructured under this regime for outstanding balances.

-Judicial deposit certificates, offsets, or account set-offs are expressly excluded as valid payment methods.

-Enforceable administrative titles (Article 828 of the Tax Statute) may be cancelled if the requirements are met

Criminal Exposure Relief

For withholding or collection failures under Article 402 of the Criminal Code, where the amount is ≤100 UVT, DIAN:

Must exhaust administrative collection; and

Will not initiate criminal proceedings, without prejudice to applying the special payment regime.

b. Reduction of Penalties for Omitted or Corrected Tax Returns and Formal Obligations

b.1 Omitted Returns

Tax returns due on or before November 30th, 2025, and not filed may be regularized by:

-Filing the return by April 30th, 2026.

-Paying 100% of the tax due

-Paying a late-filing penalty has been reduced to 15%

-No late-payment interest required

b.2 Corrections to Tax Returns

Applies to returns up to December 31st, 2025, where corrections:

-Increase tax payable,

-Reduce tax credits, or

-Reduce tax losses.

Conditions:

-Correction filed by April 30th, 2026

-Payment of tax and 15% reduced penalty

-No interest required

b.3 Formal Obligations (Including Foreign Exchange Obligations)

-Penalties for failure to comply with formal obligations may be reduced to 15%, provided that the obligation is fully complied with by April 30th, 2026.

-Applies to cases under administrative discussion where no reconsideration decision has been notified.

-Taxpayers must expressly accept all proposed adjustments, which results in termination of the administrative process.

-Includes transfer pricing formal obligations, including the informative return.

-Customs matters involving restricted goods are excluded.

c. Temporary Regularization of Formal Non-Compliance

Eligibility: Applies to formal non-compliance existing before the decree entered into force.

Economic Cost:

-3% of gross income reported in the 2024 income tax return; or

-For non-filers, 2% of gross assets as of December 31, 2025 (payable by March 31st, 2026).

Penalty Limits:

-Maximum: 1,500 UVT

-Minimum: statutory minimum penalty

-Exclusions:

Failure to file tax returns

-Transfer pricing obligations

-Customs cases involving non-presented or restricted goods

d. Judicial Conciliation in Tax, Customs, and Foreign Exchange Litigation

The Tax Authorities are authorized to enter into contentious-administrative settlements, subject to court approval.

Settlement Scenarios

1 – First or Sole Instance

-Settlement of 85% of penalties and interest

-Taxpayers must pay:

*100% of the tax in dispute

*15% of penalties

*Interest at 4.5%

2 – Second Instance

-Settlement of 80% of penalties and interest

-Payment of:

*100% of the tax

*20% of penalties and interest

3 – Penalty-Only Cases

*Settlement of 80% of the penalties

*Payment of the remaining 20%

Improper Refunds or Offsets

-Settlement of 70% of penalties

-Payment of:

*Remaining 30% of penalties

*Full reimbursement of improperly refunded/offset amounts

*Interest reduced to 30%

Key Requirements

-Lawsuit filed before December 31st, 2025

-Lawsuit admitted and no final judgment

-Settlement request filed by May 31st, 2026

-Proof of payment of:

*Amounts subject to settlement

*2024 tax return, where payment was due

5. Temporary Special Tax on Extractive Activities and Non-Deductibility of Royalties

As part of the measures adopted, the Colombian Government has introduced a 1% flat rate Temporary Special Tax for Fiscal Stability applicable for the 2026 tax year.

This new temporary tax is levied on the extraction of hydrocarbons and coal within Colombian territory, applicable at the time of:

-The first sale within or from Colombia, or

-The export of such products.

The tax applies to products classified under the following tariff headings:

-Heading 27.01 – Coal, briquettes, ovoid, and similar solid fuels.

-Heading 27.09 – Crude petroleum oils or oils obtained from bituminous minerals.

The tax is triggered by:

-Domestic sales: Upon issuance of the invoice or, in its absence, at first delivery.

-Exports: Upon filing and acceptance of the export shipment authorization.

Also, a special rule provides that where the extractor directly exports the hydrocarbons or coal, the tax is triggered only once, at the time of export.

Crude oil received by the National Hydrocarbons Agency (ANH) as payment of royalties does not trigger the tax at receipt, but only upon export.

The tax base is comprised of:

-Domestic sales: Sale value.

-Exports: FOB value expressed in Colombian pesos:

*Where expressed in USD, conversion is made using the official exchange rate (TRM) on the date of acceptance of the export authorization.

The tax applies to individuals and legal entities that sell, or export, covered hydrocarbons or coal, and that, in the preceding tax year, reported:

-Ordinary net taxable income equal to or exceeding 50,000 UVT,

-Calculated on an aggregated basis, including all related parties, as defined under Colombian transfer pricing rules.

This effectively limits the scope to large economic groups and major extractive operators

Payment and Compliance Obligations

Exports

-The exporter must pay the tax as a condition for the acceptance of the export authorization.

-Payment must match the FOB value declared.

Domestic Sales: Monthly consolidated payment must be made within the first five business days of the following month.

Adjustments: Differences between provisional and final export values require:

-Additional payment within 10 business days, or

-A refund claim if overpaid.

Penalties:

-Non-payment, late payment, or underpayment triggers:

*Customs and tax penalties,

*Default interest, and

*Formal audit and assessment procedures by the Colombian Tax Authority (DIAN).

Voluntary corrections made prior to formal charges may benefit from penalty reductions.

Temporary Non-Deductibility of Royalties

For the 2026 tax year, royalties paid in cash or in kind under Articles 360 and 361 of the Colombian Constitution do not constitute deductible costs or expenses for income tax purposes.

Determination of the Non-Deductible Amount

The non-deductible amount equals the total production cost associated with the volume of non-renewable resources paid as royalties, calculated based on:

-Annual total production costs, including extraction, treatment, storage, and related processes; and

-Unit production cost multiplied by the royalty volume (barrels, tons, or equivalent).

Exceptional Relief: Royalties may be deductible where non-deductibility would result in taxable income despite the absence of economic profit, particularly in scenarios involving sharp commodity price declines.

Use of Collected Funds

The Decree clarifies that all revenues derived from the Special Tax for Fiscal Stability and the denial of royalty deductibility are earmarked exclusively to finance expenditures under the 2026 National Budget, aimed at addressing the causes and effects of the declared economic emergency.

6. National Excise Tax

For tax year 2026, goods classified under tariff headings 87.11 and 89.03, as well as those listed in Article 512-4 of the Tax Code, are subject to the National Excise Tax at a rate of 19%.

Tariff position heading 87.11 refers to Motorcycles (including mopeds), and cyclecars, with or without sidecars.

Tariff position heading 89.03 refers to Yachts and other pleasure or sporting boats, rowing boats, and canoes.

The goods listed in the said Article 512-4 are:

-Tariff position heading 87.03: Motor vehicles of the passenger/family type, sport-utility vehicles (SUVs), off-road vehicles, and pick-up trucks, whose FOB value or equivalent FOB value is equal to or greater than USD 30,000, including their accessories.

-Tariff position heading 87.04: Pick-up trucks whose FOB value or equivalent FOB value is equal to or greater than USD 30,000, including their accessories.

-Tariff position heading 88.01: Balloons and airships; gliders, hang gliders, and other non-engine-powered aircraft for private use.

-Tariff position heading 88.02: Other aircraft (for example, helicopters and airplanes); spacecraft (including satellites), and their launch vehicles and suborbital vehicles, for private use.